An 8,764 percent rise within the shares of a firm with a minuscule people shareholding has prompted the Securities & Exchange Board of India(In) to discuss modifying its regulations for companies rising from that country’s bankruptcy procedure.

The regulator has sought comments on a proposal to cut the time given to businesses that re-list after bankruptcy solution to boost the free float to at the least 10 percent in 6 mos from 18 mos presently. The rule mandating such businesses to eventually gain to the min. shareholding of 25 percent in 3 yrs. of re-listing remains.

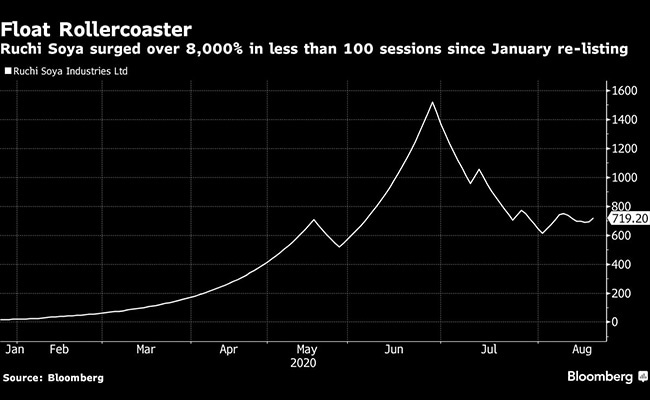

“In 1 previous complaint it has been noticed that post insolvency solution procedure, the people shareholding decreased to 0.97 percent, & demonstrated 8,764 percent rise in its distribute cost,” SEBI’s consultation paper stated, listing Ruchi Soya Industries Ltd. & 4 different businesses that re-listed between Sep 2018 & Feb.

Ruchi Soya has been acquired by a Yoga guru Baba Ramdev’s Patanjali Ayurveda-led consortium previous year via an insolvency solution procedure. The founders conducted 99.03 percent of the firm’s capital as of Mar 31.

The negligible free float saw Ruchi’s shares soar from regarding ₹ 17 at the moment of re-listing on Jan 27 to ₹ 1,519 on Jun 26. The cost has from halved. Still, in its peak, the firm has been valued in $six billion, in front of bigger consumer-staples producers involving Marico Industries Ltd. & Colgate-Palmolive India(In) Ltd. The stock stopped down 3.29 percent in ₹ 696.20 in Mumbai (Bombay) on Thu..

“Such low people shareholding rises several issues like failure of fair discovery of cost of the scrip, want for rised surveillance steps and so on. & may thus pose as a red flag for future instances,” the regulator stated.

Market participants have till Sep 18 to submit their own views on the proposal.

Ruchi Soya swung to a profit of ₹ 12.26 cr ($1.six mln) within the quarter stopped Jun, awhile its revenue dropped five percent from that preceding three-month period to ₹ 3,040 cr.